Success story

Chilean company in charge of managing the country's bank credit and debit cards.

Transbank S.A., is a Chilean company that supports the banking business whose partners are the most important banking and financial entities in the country.

Manage Visa, MasterCard, Magna, American Express and Diners Club Credit Cards. Manage the Redcompra Debit card (Electron and Maestro). It manages the Internet shopping service, Webpay, which allows the secure exchange of information.

With the headquarters in Santiago, 6 regional offices and 6 branches in the main cities of the country. It operates in a network of more than 120.000 affiliated points of sale.

Contested transactions, their reasons and the management to collect evidence.

Among the hundreds of thousands of payment transactions that Transbank intermediates every month, both in person and online, a percentage of objected transactions is generated.

The disputed transactions occur in all types of businesses and industries, and are originated for various reasons, which can range from a fraud reported in the transaction, to the buyer's claim because the merchandise or service was never delivered by the supplier.

For all cases, Transbank must coordinate with its customers-businesses, obtaining the evidence required to review each case and thus correctly assess whether the reverse of the transaction corresponds.

Finally, it should be noted that the information required to obtain evidence is not the same for all industries or types of commerce. For example, the documentation required for a claim for a flight canceled by an airline is not the same that is needed to review an online purchase fraud.

Manual process:

The Transbank Exchange team is responsible for carrying out this process:

A person dedicated exclusively to these tasks to be able to inform only 20 businesses 2 times a week.

To advance the challenge of digital transformation of this Exchange area, Transbank hires MasterBase® as a process automation platform.

After a few weeks of the survey, the MasterBase® team manages to deliver the first tests of the process.

The automated process had to cover the need to communicate, in a fast, automatic and efficient way, to each client-business the objected transactions and the documentation to be sent, generating results indicators of the email deliveries.

One of the main advantages of automating processes through MasterBase® is that these are configured from pre-existing tools, which are configured within a process according to the need, this methodology is called #Configware and was one of the challenges in this case.

The process takes information from 3 sources:

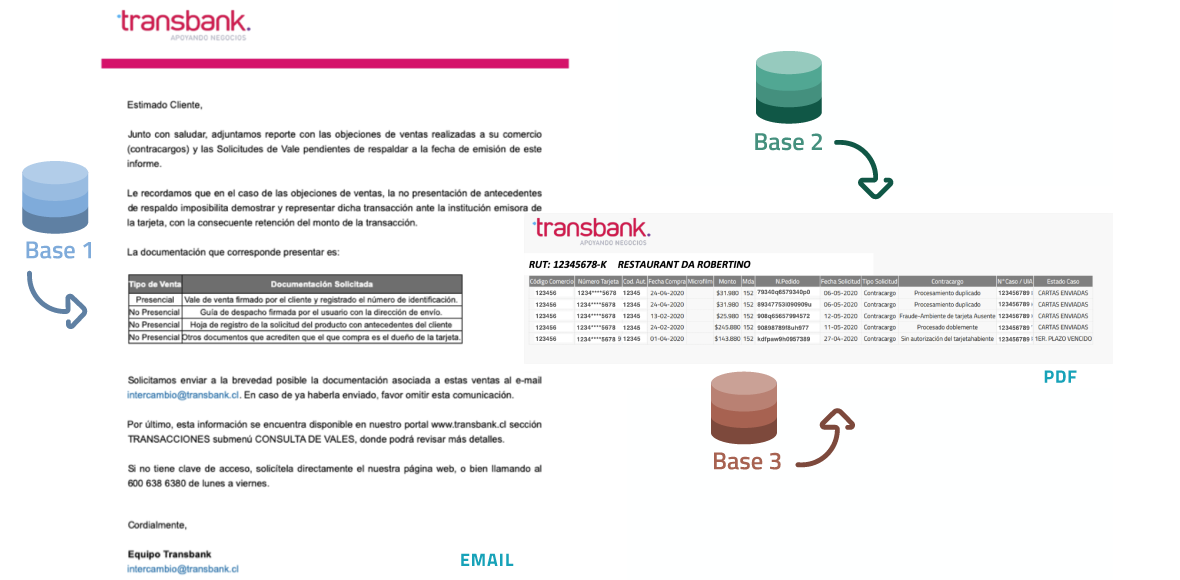

The process takes as key the rut of each trade (obtained from base 1)

Cross it with the objected transaction records (obtained from base 2)

Create a report in PDF format that provides a table with all the details of the rejected transactions (with the data obtained from base 2)

The PDF file is attached to an email that is generated automatically

The type of documentation that must be delivered by each business is detailed in the body of the email (obtained from base 3)

The shipment is made to the contacts corresponding to each business (obtained from base 1)

Documentation that the customer-merchant must present as evidence to investigate and manage the claim.

Contacts defined by each.

Objected transactions that must be reported to the customer-merchant.

Result: The process automatically crosses the data and generates a personalized message to each merchant with the rejected transactions that must be reviewed and with the documentation that must be sent as evidence.

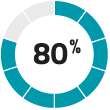

The declined transaction resolution process is now more efficient and effective thanks to automation in the MasterBase® platform. In the last month he achieved:

communications with associated customers-businesses.

Growth in the opening rates of your email marketing communications.

Thanks to this automated solution achieved on the MasterBase® platform, the Transbank Exchange area has achieved:

He managed to increase the coverage of clients.

Reduced work times in the process of notifications of objected transactions.

Transbank's requirement included the need to load and cross different databases, generate PDFs, encrypt them, and send thousands of mails.Implementing this automation using #Configware allowed the operating process to take less than 1 weeks, without the need to consume time and development and programming resources. Adjustments and modifications to the process are also made quickly thanks to this methodology.

We turned to MasterBase® for its recognized track record and we obtained a more than satisfactory result.

For us, it was a huge human and technical effort to carry out the entire process of objected transactions from our clients - businesses.

Thanks to automation with MasterBase®, we managed to reach 100% of our clients, improving the quality and timeliness of the information.

Now our team has more time to focus on our business to improve services to our clients.

The MasterBase® team reacted very quickly and did an excellent survey of the situation to achieve a positive result in a couple of weeks.

Thanks to this, we are now thinking of expanding this method to other communications to our clients, and to automate other areas of our company.

Exchange Area